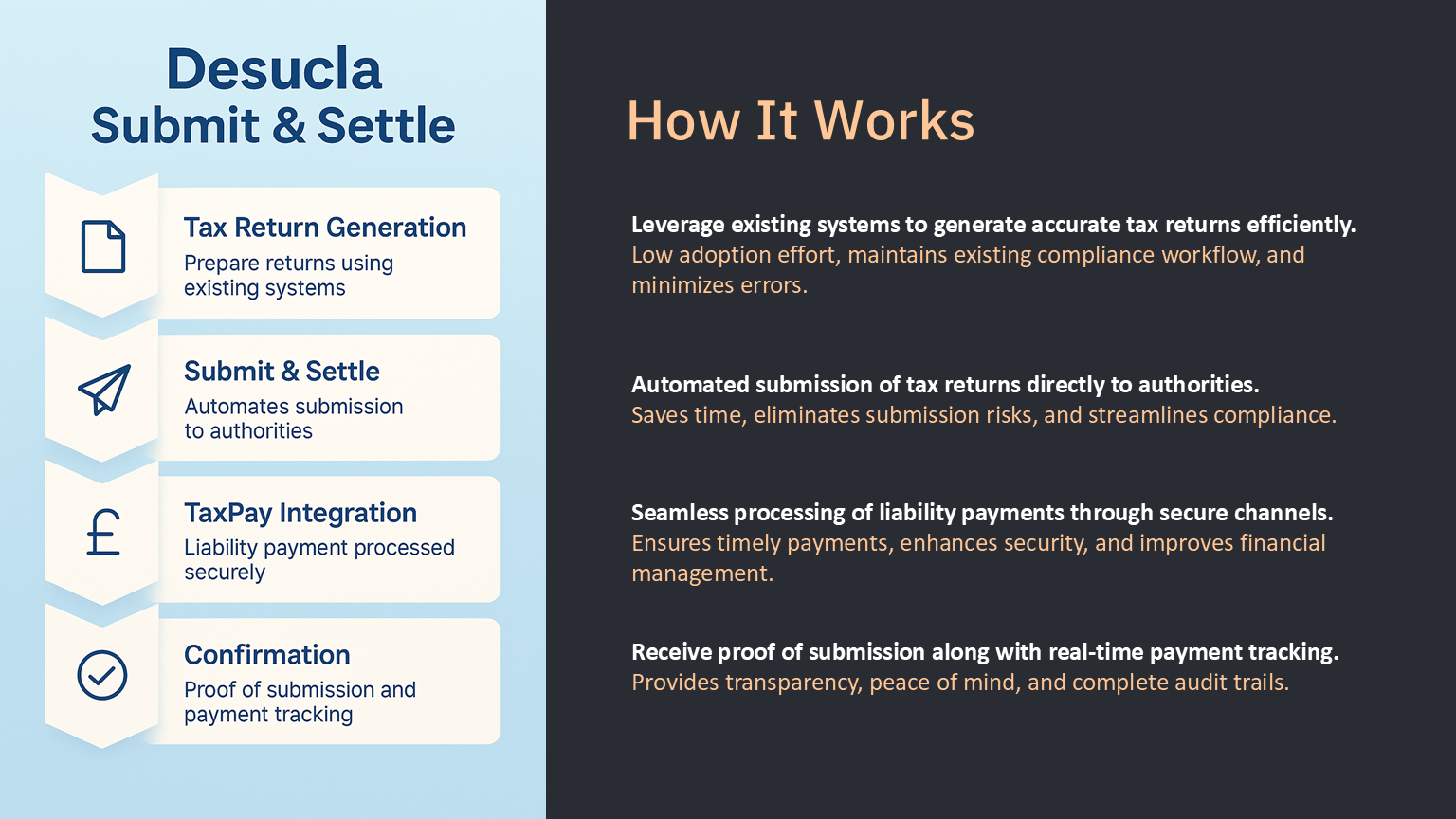

SUBMIT & SETTLE KEY FEATURES

Automated Submissions:

100+ submission options, covering a wide range of tax types and countries. Including VAT, GST, IOSS, OSS, Digital Services Tax, EPR, Sales Taxes & more. Countries include North America, Latin America, Europe, Asia-Pacific , and the Middle East.

Partner Integration:

Works with established platforms, open API integration available. Integration will all accounting firms, compliance providers and tax technology providers – works with your existing compliance flows.

Integrated Tax Settlement:

Using Desucla TaxPay to automate the process of generating payment instructions that match the required tax authority currency, account details, payment method and sequencing with returns. Reducing duplication of effort (no re-keying) and the risk of errors being introduced.

Designed for Tax Payments:

Using our regulated banking partners we overly that localised logic required to ensure liabilities are not only paid but reconciled correctly. This includes local payout options, direct debits, timing of payments (pre-return, post return and time based) etc.

Compliance & Audit:

Full transparency as standard, real time visibility of all submission and settlement stages including proof of submission and proof of payment. Including automated tax authority notifications (where required) to confirm settlement initiated.

Global Coverage:

A single provider to support all submissions and settlements internationally, designed with regional and local support (critical to support tax authority operating timings) in mind. Ready to add jurisdictions when you need them.

Flexible Options:

Backed by our friendly & responsive support team, guided on-boarding, service operation and support. Flexible configuration of workflows to support your specific business needs.

Referencia de pago inteligente y comprobación del beneficiario para minimizar los errores y garantizar una experiencia fluida en todo momento.

PAÍSES BENEFICIARIOS

Admitimos una amplia gama de países/monedas para los Pagos TAX con la capacidad de recibir una variedad de monedas (ejemplos a continuación). Se pueden añadir rápidamente otros países y divisas previa solicitud.

- Austria

- Bélgica

- Chipre

- República Checa

- Dinamarca

- Estonia

- Francia

- Grecia

- Hungría

- Israel

- Italia

- Japón

- Lituania

- Malta

- Países Bajos

- Noruega

- Polonia

- Portugal

- Rumanía

- Singapur

- Eslovaquia

- Eslovenia

- España

- Suecia

- Suiza

- Reino Unido

¿CÓMO PUEDO INSCRIBIRME?

Reach out to our team of experts for personalized consultations. Our experts are here to guide you through the on-boarding process, answer any questions you may have, and ensure that our service aligns with your business needs.

Utilize our user-friendly online platform for seamless onboarding. Register your business, input the necessary details, and initiate the process to start benefiting from Submit & Settle.

Once on-boarded, experience the difference that Submit & Settle brings to your last mile processes.